Who We Serve

Work with a financial planner who understands complex Personal finance Situations

and helps align your plans with your goals.

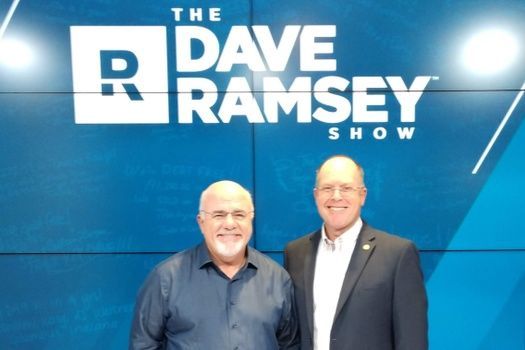

"Find an investment professional in your area with the heart of a teacher."

-Dave Ramsey

Our SmartVestor Pro Partnership

Being a SmartVestor Pro means we agree to serve clients with a high standard of care and transparency. It also means we support the belief that people make better financial decisions when they understand how money works. Many of our clients discover us while searching for an advisor who will take time to explain concepts, walk through options, and provide straightforward advice without pressure. That is exactly what they experience here.

Falstad & Associates is an independent firm, so our recommendations are based solely on what aligns with your goals. The SmartVestor Pro connection simply adds another level of accountability and trust. It reflects our commitment to serve with integrity, communicate clearly, and build a long term partnership that supports your financial life.

If you connected with us through Ramsey Solutions, Welcome! If you are exploring whether a SmartVestor Pro advisor is right for you, we would be glad to discuss your questions and help you understand what working together entails.

Planning for a fulfilling life today and a secure future tomorrow

Families & Retirees

Families and retirees across Bloomington and Central Illinois want clarity about the future. Many hope to enjoy their retirement years without uncertainty, support their children, and feel confident that their savings will last. They often want direction on when to retire, how to draw income, how to manage investments as they age, and how to prepare an estate plan that reflects their values. Falstad and Associates helps them create a path that balances present enjoyment with long term stability.

These clients are naturally interested in retirement planning, the steady guidance of investment management, and estate planning that organizes their wishes for those they love.

A personalized plan that helps you understand your income needs, timing decisions, and long term goals so you can move into retirement with confidence and clarity.

A thoughtful, long term investment approach designed to grow your savings, manage risk, and support the retirement lifestyle you envision.

Guidance that helps you organize your accounts, understand your wishes, and prepare a legacy plan that brings clarity to your family’s future.

Support when life feels unfamiliar or overwhelming

Transitional Life Stages

Divorce, loss, caregiving, and major life transitions bring both emotional weight and financial complexity. People in these seasons want a clear understanding of their new financial picture and the reassurance that they can rebuild with confidence. They want steady conversations, calm guidance, and a partner who respects the pace at which they need to move. Falstad and Associates helps them understand their accounts, reorganize their plan, and begin moving forward with clarity and purpose.

These clients frequently engage in financial confidence after loss or divorce, trust and estate guidance that supports new responsibilities, and long term care planning that protects their future wellbeing.

Support that helps you understand your new financial picture, rebuild stability, and move forward at a pace that feels steady and manageable.

A coordinated approach that helps you align your assets, intentions, and legal documents so your long term wishes are clearly understood.

Planning that helps you prepare for future care needs, understand your options, and protect the progress you have already made in your financial life.

Balancing business success with personal financial security

Business Owners & Professionals

Business owners, physicians, executives, and professionals often face financial complexities that blend personal and professional life. They want clarity about retirement plans, tax decisions, business transitions, and income protection. Many carry demanding workloads and want someone they trust to help them make thoughtful financial decisions while they focus on leading their company or building their career. Falstad and Associates acts as a steady partner, helping them align their business ambitions with a strong personal plan.

These clients naturally gravitate toward business retirement plan design, long term tax strategies, and income protection planning that supports their families if work becomes interrupted.

Strategic retirement plan design that supports your employees, strengthens your business, and helps you build personal financial security.

Thoughtful, year round tax planning that helps you make informed decisions about income, distributions, and long term financial goals.

Secure your financial foundation with life, disability, and long-term care insurance solutions.

Beginning the journey toward long term financial confidence

Young Investors & Rural Clients

Young professionals, early-career families, farmers, and rural clients often look for simple, practical guidance. Many want to learn how to invest for the first time, build strong financial habits, or understand how land, seasonal income, or early savings fit into long term goals. They want clarity without complexity and a partner who teaches without judgment. Falstad and Associates helps them approach their financial life with intention from the very beginning.

These clients tend to explore legacy and land planning, the development of everyday financial habits, and support for starting their investment journey.

Guidance that helps you plan for family property, farmland, or acreage so its meaning and value can transition smoothly across generations.

Simple, consistent routines that help you understand your money, build confidence, and create long term financial stability.

Clear, patient instruction that helps you learn how investing works and begin building a future grounded in steady, intentional growth.